Should I Registered Tax Preparer To Ea

Your Pathway to Becoming an Enrolled Agent

The 2021 Comprehensive Tax Course is available now and meliorate than ever!

Plus, more than new, revised content coming very shortly!

Now includes pointers yous'll capeesh as useful, practical advice to be practical in your daily piece of work. Materials concentrate on advancement of careers and profitability. Plus, relevant updates provided regularly so you remain informed on your craft!

What is an Enrolled Agent?

An Enrolled Agent is a tax expert and it is the highest credential in the tax industry, awarded past the IRS.

An Enrolled Agent (EA) has earned the privilege of representing taxpayers before the Internal Revenue Service (IRS) by either:

- Passing a three-office comprehensive IRS test covering individual and business tax returns, OR

- Through experience as a erstwhile IRS Employee

Fast facts about Enrolled Agents

- Enrolled Agents, like attorneys and certified public accountants (CPAs), take unlimited practice rights, meaning they are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they tin can represent clients before.

- The Enrolled Agent credential is nationally recognized, as they are federally authorized by the IRS to practice in whatsoever country. Interestingly, CPAs accept to be licensed separately in each land they wish to practice in.

And what's fifty-fifty more interesting…

- You don't need a college degree to become an Enrolled Agent.

- You lot don't demand to know accounting or high level math to become an Enrolled Agent.

- In that location is a shortage of Enrolled Agents, who can handle more complicated tax returns and represent clients before the IRS.

- Your earning potential is much greater when you become an Enrolled Agent because yous have a college level of tax knowledge and are an unrestricted, meaning yous are able to practice more than things for your clients. You tin easily work yr-round assisting clients with taxation preparation and many other unlike tax issues.

- You lot can pass the three-part Enrolled Agent Exam, too called the Special Enrollment Test (Encounter), one function at a time, and yous have two years from passing the first exam to pass all three parts! This makes studying and passing the SEE exam much more than manageable!

Non sure where to start?

If y'all're interested in condign a Tax Preparer or already are 1, it makes slap-up sense to work towards becoming an Enrolled Agent. Currently the IRS has a voluntary program for tax preparers, the Annual Filing Season Program (AFSP). Without completing this bare minimum programme or having any other recognized credentials, you lose very basic representation rights for clients whose returns you prepared.

If yous can't talk to the IRS on your clients behalf, you may lose them! And with IRS examinations on the rise, this is becoming increasingly important. The AFSP too includes a yearly six-hour course and test, plus 15 hours of annual CE. If you are going to do the AFSP, why not go one stride further and work towards the highest credential the IRS awards? — and increase your knowledge and credibility at the same time!

Standing your education enables yous to fix more than complicated tax returns, which in turn allows you to charge more and abound your business! In addition, y'all can also become specialized in sure areas and be known equally "the proficient." Call up virtually what your regular family doctor makes for a living and how many patients he/she might come across in a day. Now think about what a heart surgeon makes for a living and how many patients he/she might meet in a day. The heart surgeon makes a lot more money and sees far fewer patients on a daily ground. The more than you know, the more you tin charge and the more your business concern will grow!

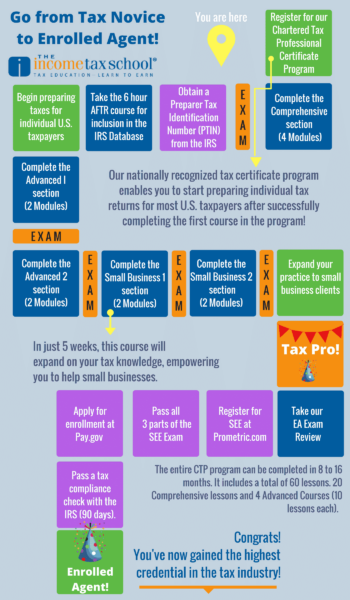

Steps to becoming an Enrolled Agent

Step ane: Enroll in the Chartered Tax Professional CTP® document program

This online certificate program leading to the professional person CTP® designation includes five courses totaling 157-hours of instruction. The courses teach yous tax preparation from the very beginning and can be completed in simply 18 months or less. The CTP® curriculum includes most topics on the EA exam and CTP® graduates are well prepared to pass the EA Test after completing a Surgent EA Exam Review, also available through The Income Tax School.

Already have some experience?

Experienced tax professionals tin can ordinarily "examination out" of the first course, the Comprehensive Tax Course, which is 48 hours of instruction. The cost to exam out of the Comprehensive Revenue enhancement Course is $100.

Non sure yous're set for the CTP® certificate programme?

You can start with the kickoff form in the certificate programs, the Comprehensive Tax Form, and upgrade to the CTP® plan at a later time. There are as well ii lower tiered Chartered Taxation Document Programs you can first with, besides as 2-course bundles including the Comprehensive Taxation Course. So every bit you tin can see, there are several options you lot can choose from that are stepping stones to condign an Enrolled Agent. Sometimes you just need to get your feet wet then you're ready to jump right in!

- Larn about all 3 Chartered Revenue enhancement Certificate Programs

- Learn almost testing out of the Comprehensive Revenue enhancement Form

Courses included in the CTP® program:

- Comprehensive Tax Course

- Advanced I Taxation Form

- Advanced II Tax Course

- Small Business concern I Revenue enhancement Course

- Pocket-sized Business organisation Ii Tax Course

Additional Requirements:

- Almanac CE requirement (beginning the year afterwards yous qualify equally a CTP®):

- 15 Hours (9 hours federal revenue enhancement police, 3 hours ethics, three hours federal tax law updates)

- Experience requirement:

- 300 Hours must be completed before final CTP® certificate is issued. After completing the beginning revenue enhancement form, you'll accept the tax knowledge to prepare private tax returns for virtually all U.S. taxpayers and you can outset working towards your experience requirement. Plus, you'll start earning money!

- Larn more near requirements

- View our CTP Timeline Schedule

Step two: Consummate a Surgent EA review form

Later you've gotten a few taxation courses under your belt, yous should consider registering for Part ane of Surgent's EA Review Course and you tin work toward your EA status in tandem. This volition put you on the fast track to becoming an Enrolled Agent!

The Income Tax School is now part of Surgent, and Surgent's EA Review (formerly Examination Matrix EA Examination Review), is a leader in EA Exam grooming, which will help yous prepare for the EA Exam (SEE exam).

- New EA Exam Review innovations – Intelligent Software

- Over one,800 Multiple-Selection Questions – With Total Text Answers

- Upward-to-Date IRS Publications – Built Right Into the Software

- Over lxxx% Laissez passer Charge per unit

- Simulated Exam Mode

- Pass or Refund Guarantee

Step three – Accept the IRS Run across exam

Individuals wishing to become an IRS Enrolled Agent must take and laissez passer the IRS Special Enrollment Examination (Encounter). Equally mentioned above, you can accept and one part at a fourth dimension. You have two years from passing the outset exam to pass all three parts of the exam. This makes studying and passing the SEE exam much more manageable! At that place are fives steps to the exam process:

- Create an Account with Prometric, if you lot don't accept one.

- Review the Candidate Information Bulletin – This bulletin volition provide you with important information about the examination and the process for becoming an Enrolled Agent. Review the Candidate Information Bulletin

- Review Exam Content Outlines – Read the total detailed test specifications to become familiar with the content of each part of the test.

- Prepare for your Examination – Please review the Candidate Data Bulletin for test content and scoring data, test center regulations and ID policies, registration and scheduling issues and contact information.

- Register and Schedule Your Exam – Prior to scheduling an examination appointment y'all must register for each part of the examination that you wish to take through Prometric, who administers the exam for the IRS. At that place is a $182.00 fee per part paid at the time of appointment scheduling. The test fee is non-refundable and non-transferable.

- Have your Test which will be taken at a Prometric Testing Center.

Extension of the two-twelvemonth carryover flow – Updated July 9, 2020

More often than not, candidates who pass a function of the Meet examination can deport over a passing score up to two years from the date they passed that function of the exam. To provide candidates flexibility in testing during this period of global emergency, we are extending the two-yr period to iii years. This applies to any test parts that had not expired as of Feb 29, 2020 and any test parts passed on June 1, 2020 and later. For example, assume a candidate passed Part i on Nov xv, 2019. Subsequently the candidate passed Part 2 on Feb xv, 2020. That candidate has until Nov 15, 2022 to pass the remaining function. Otherwise, the candidate loses credit for Part 1. The candidate has until February fifteen, 2023 to pass all other parts of the examination or volition lose credit for Office two.

In another example, assume a candidate passed Office 1 on June 1, 2020. Afterwards the candidate passed Part 2 on September 1, 2020. That candidate has until June i, 2023 to pass the remaining part. Otherwise, the candidate loses credit for Part ane. The candidate has until September 1, 2023 to pass all other parts of the examination or will lose credit for Part 2.

Step iv – Register with the IRS as an Enrolled Amanuensis

- Successfully pass all iii parts of the EA exam (SEE examination) within two years.

- Obtain or go on to maintain your Preparer Tax Identification Number (PTIN) through the IRS.

- Use for enrollment past completing the Pay.gov Form 23 Enrolled Amanuensis application and pay $67.

- Pass a suitability cheque, which will include revenue enhancement compliance to ensure that you have filed all necessary tax returns and in that location are no outstanding tax liabilities; and criminal background. Successful examination candidates usually take the procedure completed within ninety days of receipt of their awarding.

Former IRS Employees. If you have the required number of years of technical experience in the IRS (see department 10.4(b) of Circular 230), yous may employ for enrollment and request SEE waiver

Send the following information to the IRS:

- A completed Class 23;

- Any information regarding formal education, grooming, licenses, and work feel (other than IRS work feel) that would impact on the blessing of your application; and

- A bank check for $67.

Come across Class 23 PDF for additional details.

If yous are a old IRS employee, the SEE waiver will not grant you unlimited enrollment unless your application establishes that your technical experience has provided you lot with special competence in tax matters sufficient to allow yous to successfully pass the Special Enrollment Exam. The former IRS employee review adds substantially to the processing fourth dimension. Nosotros estimate that the average fourth dimension to process most applications for enrollment to be 3 months. However, some applications may accept significantly longer.

Stride 5 – Continue your educational activity to maintain your EA credential

Individuals who obtain the Enrolled Amanuensis status must adhere to ethical standards and consummate 72 hours of continuing teaching (CE) courses every three years. A minimum of xvi hours must be earned per twelvemonth, two of which must exist on ethics. Enrolled agents must employ an IRS canonical CE provider.

Get started today! Choose your pathway to becoming an EA

Should I Registered Tax Preparer To Ea,

Source: https://www.theincometaxschool.com/continuing-education/your-pathway-to-becoming-an-enrolled-agent/

Posted by: johansenwhang1968.blogspot.com

0 Response to "Should I Registered Tax Preparer To Ea"

Post a Comment